NFTs for Beginners:

Everything You Need to Know About The Latest Crypto Craze

NFTs (non-fungible tokens) might be the most confusing commodity on the internet right now. At its most basic, an NFT is computer code that represents ownership of digital items. But what does that actually mean? And why are they suddenly exploding in value?

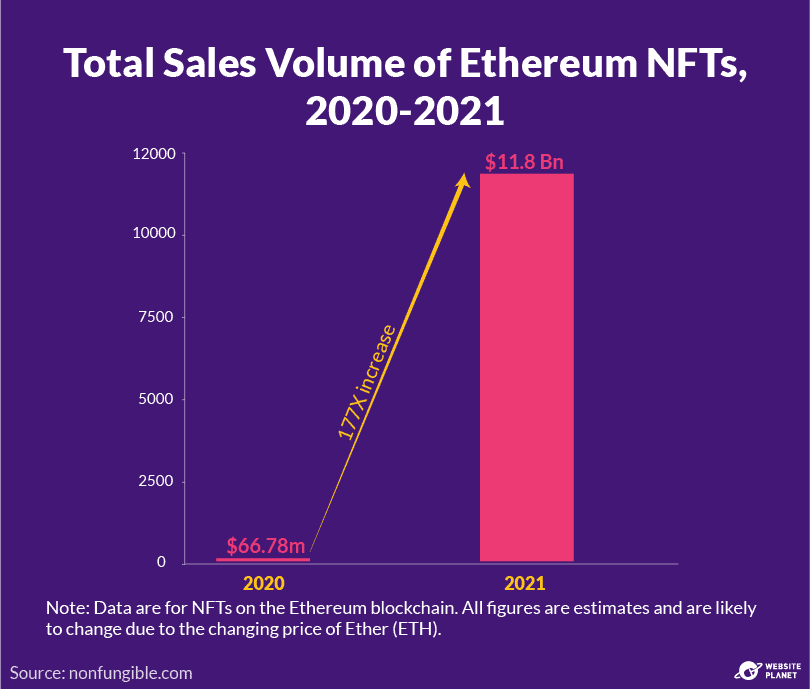

How did global NFT sales rise by 30,000% from 2020 to a total of $41 billion in 2022? And are you missing out (or dodging a bullet) if you don't invest?

This article is your comprehensive guide to NFTs. We'll provide an overview of NFTs, how they work, and their real-world applications. We'll also show you how to successfully create, buy, and sell NFTs.

Quick Summary: What Are NFTs?

Before we can fully define non-fungible tokens, we need to get comfortable with a few key concepts. Let's start with the difference between fungible and non-fungible assets.

Fungible Assets

'Fungible' is a word you don't hear much in conversation, but the general idea is simple: when something is fungible, it means it can be exchanged or traded for an identical item with the same value. If I have an unopened can of soda, for instance, I can exchange it for an identical can of soda. The can of soda is fungible.Physical currencies and bitcoin are examples of fungible assets. This means they have three broad qualities:

- They can be traded and exchanged. $1 can be traded with another $1, because...

- They have equal value. 1 bitcoin is equal to 1 bitcoin.

- For physical currencies, this system of trade works because everyone agrees to it. With bitcoin, the value is stored on the blockchain (explained below).

Non-Fungible Assets

NFTs are different from physical currencies and bitcoin because they're non-fungible.In the most basic terms, this means every NFT has a completely unique value and can't be easily traded or bartered for another NFT (unless both parties involved decide they share the same value, which probably never happens).

1 NFT does not automatically equal 1 other NFT. They can have vastly different values, which are completely subjective and unique to that specific NFT.

If I ordered a custom birthday cake for my friend, I can't go back to the bakery and exchange it for a different cake, because the cake I have is unique. Similarly, if I am the owner of an NFT, I have a unique digital item that cannot be replaced with an identical one.

Why does any of this even matter, you ask? Well, it's what makes each NFT a unique collectible item that actually holds value. How much value, exactly? That varies widely. An NFT can represent the ownership of anything from a GIF file (yes, some of those are actually owned by people), a piece of artwork, a video game element like a character or costume, or even a plot of real estate.

Blockchains

NFTs are stored on blockchains. These public ledgers record the existence and ownership of each token, and cannot be changed later. NFTs signify the ownership of a physical or digital item. Each NFT is a crypto asset with a unique identification code and metadata that makes it unique from other NFTs.We'll go into that a bit later, but for now, the important thing to understand is that blockchain records are unchangeable. This means that when someone owns an NFT, whether for a physical or a virtual item, it's official.

| Blockchain | An anonymous, unchangeable, and publicly accessible log (public ledger) that records transactions in chronological order. Blockchains are decentralized and information about the network's transactions is stored in batches called 'blocks.' |

| Decentralized | Describes an organization in which operations and administrative powers are delegated away from a central authority to several smaller groups or individual parties. |

What's the Point in NFTs?

When you buy something in the physical world - like a cake - it has unique properties and a limited quantity. A receipt, a deed, or just having the item in your possession can prove that you own it.The internet doesn't permit ownership of digital items in the same way you can own something physical. NFTs are supposed to bring some of the structure that applies in the physical world to the digital, allowing digital assets to be scarce in number and distinct from each other.

Advocates of NFTs also say they provide the security of 'proof of ownership' needed online.

NFTs can be sold through different NFT marketplaces, person-to-person, in exchange for cryptocurrency. NFT marketplaces are online platforms that allow you to buy, sell, and create NFTs.

| Cryptocurrency | A decentralized digital currency that is secured and created by cryptography.Right now, NFTs are used to represent: |

- Artwork

- Music

- Video footage Collectibles such as trading cards

- Virtual items within games including character outfits and in-game currency

- Virtual land in metaverses*

- Legal documents

- Signatures

- Tokenized real-world assets such as deeds to a car, real estate, or sneakers

Supporters of NFTs hope they become used for more and more things, as the internet becomes increasingly decentralized.

| *Metaverse | A virtual space where users interact with the environment and each other. Metaverses incorporate features of social media and gaming. They often use virtual reality (VR) and augmented reality (AR), and can be built on a blockchain. |

How NFTs Work

Now that we've covered the basics of NFTs, let's dive a little deeper into how they work.NFTs are crypto assets. This means that they are secured by cryptography, like cryptocurrencies such as bitcoin and ether. Unlike cryptocurrencies, however, NFTs aren't used for commercial transactions.

| Cryptography | A way to encode information to secure communications. Cryptography allows only a sender and recipient to view the contents of a message. |

How Do Blockchains Work?

Blockchains, as well as being essential to how NFTs work, are also one of the more confusing parts of this story. But once you string the ideas together, it will all make sense.They are called blockchains because they are built of strings of computer code - called blocks - that are then chained together. Each block is encrypted (i.e. information is encoded through cryptography) and has a storage capacity.

Once a block is full of data, it's closed and the data within it is permanently recorded.

New blocks are created to record the next batch of data and each new block links to the previous block, creating the blockchain. This is different from traditional databases that store data in tables.

New blocks are created through a process called mining. Usually, blockchain miners have to solve complex cryptographic algorithms to create new blocks. Mining takes time and uses a lot of computing power, and miners are financially rewarded when their block is added to the chain.

Blockchains are used to publicly record transactions. Each blockchain is stored across multiple computers that are linked in a peer-to-peer network. This means that computers in the network all share files. This decentralized sharing of information is what builds trust into blockchains.

Every computer in the network has a copy of the blockchain. To change the information a blockchain stores, the blockchain would first have to be decrypted, and then the information on each computer in the network would have to be changed at the same time.

Because each blockchain is maintained by its network of users, they can keep a safe record of transactions without a central organization and workforce to log, store, and maintain the data.

People trust the accuracy of blockchains because how this data is stored makes it almost impossible to manipulate.

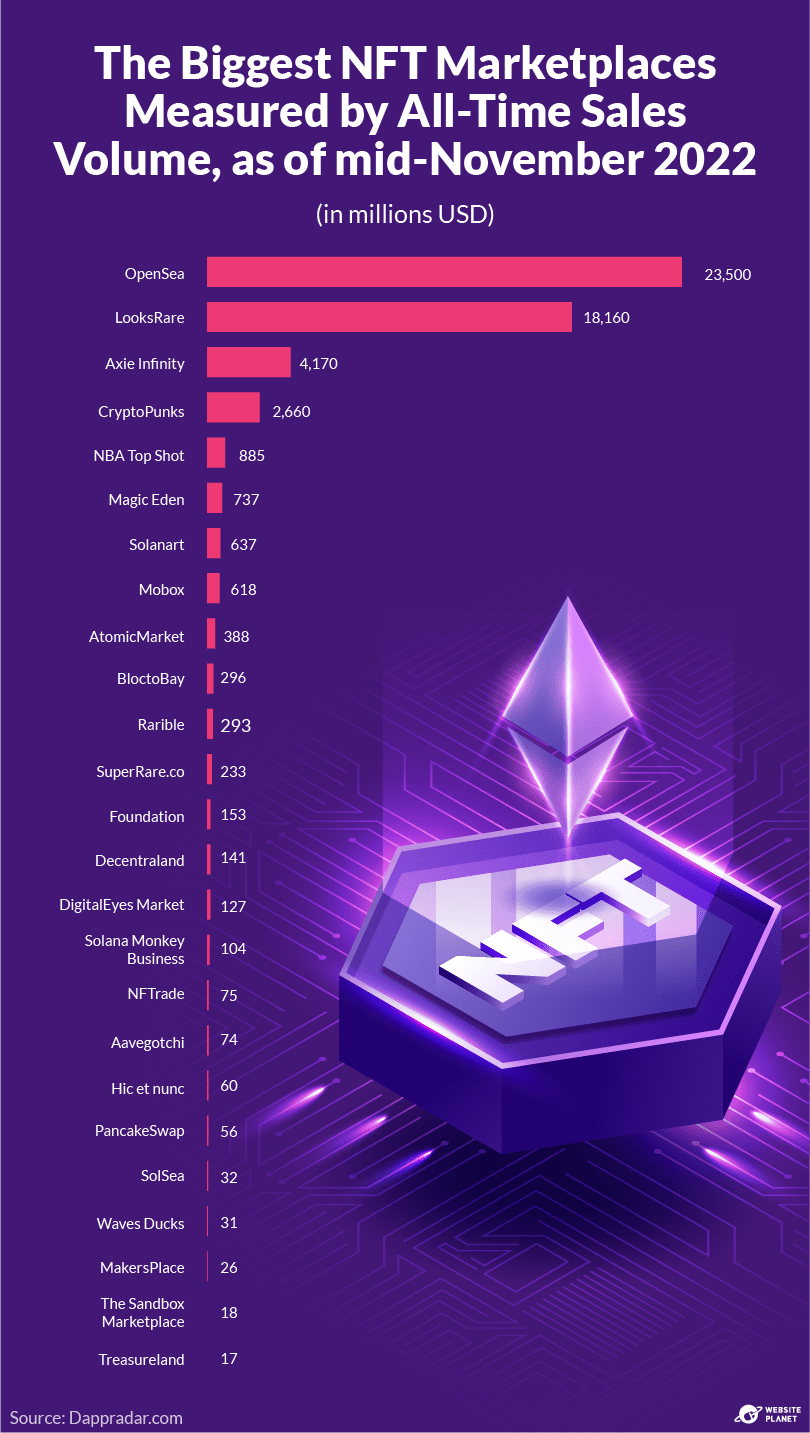

How Do NFT Marketplaces Work?

NFTs are bought, sold, stored, and displayed on online platforms called NFT marketplaces. NFT marketplaces are similar to ecommerce platforms like eBay; users list their NFTs, which buyers can bid on. These online platforms are separate from the cryptocurrency exchanges where users buy, sell, and trade currencies such as Bitcoin or Ethereum.NFT marketplaces usually support several blockchains; users can only trade NFTs that are built on supported blockchains and use cryptocurrencies that are compatible with those NFTs.

Most NFTs are stored on Ethereum, which means these NFTs are compatible with Ethereum-based NFT marketplaces. An NFT bought with ether on one platform can be sold on another.

Only a few marketplaces accept traditional currencies like the US dollar. These marketplaces automatically convert the tender into the appropriate cryptocurrency.

How Are NFTs Created?

The process of creating an NFT is called minting. Most NFT marketplaces allow you to mint NFTs, and there are several dedicated NFT minting sites. To mint an NFT, you simply upload a digital file to the NFT marketplace, fill in some details, and click Create. You can turn most digital files into NFTs, including images, videos, and GIFs.

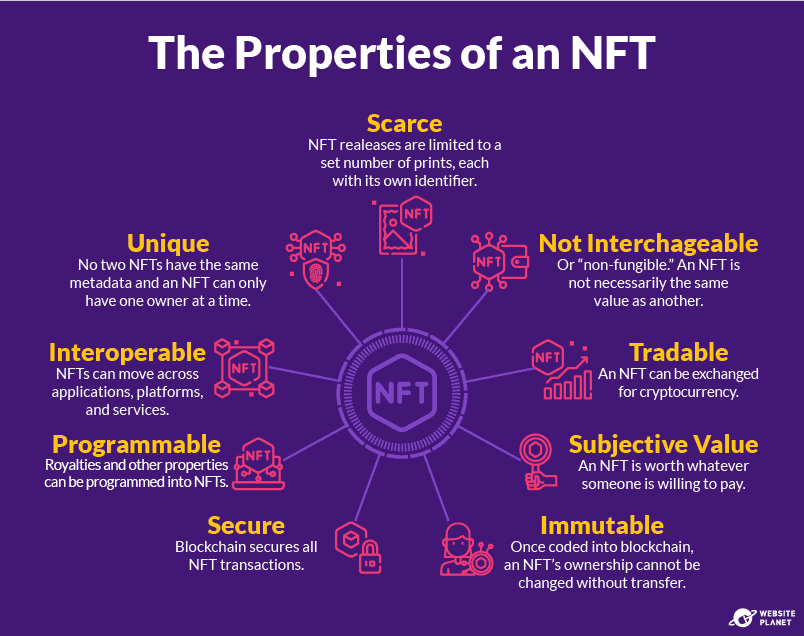

The Properties of NFTs

NFTs have some important properties - such as their uniqueness, scarcity, and tradeability - that make them work.

Unique Asset Ownership

Each NFT represents a single digital or physical asset, and most NFTs only have a single owner at a time. Ownership of an NFT is secured and traceable because it's recorded on a blockchain (the Ethereum blockchain for most NFTs).

| Ethereum | A decentralized platform that's powered by a blockchain. Ethereum is known for its smart-contract functionality and its native cryptocurrency, ether (ETH). |

| Smart Contract | A self-executing, trackable, and irreversible contract with terms between parties written into its code and stored on a blockchain. NFTs are created through smart contracts and can even be contained within smart contracts. |

Because NFT smart contracts are stored on a blockchain - and because blockchains are decentralized, anonymous, and unchangeable public ledgers - no one can change the ownership of an NFT without a legitimate transaction. Proof of ownership is unchangeable.

Your NFT will always be referenced on a blockchain, which is difficult to lose unless you forget your crypto wallet details. This allows NFT ownership to be authenticated.

Each NFT has a public and private key. The NFT's creator holds the public key, and this never changes - a public key is a certificate of authenticity that proves the origins of the NFT. The corresponding private key acts as proof of ownership. When they sell their NFT on a marketplace, a creator retains the public key while the private key is traded to the new owner.

| Public Key | Used to encrypt communications. They are visible to everyone in a system, and each public key has a corresponding private key. |

| Private Key | Can decrypt (and read) communications that were encrypted by the related public key. Private keys can also encrypt and decrypt messages with the same key. They are stored on a user's device and have a single owner. |

| Crypto Wallet | Stores the addresses and public/private key pairs for the owner's cryptocurrency transactions. Can be used to send, receive, and spend cryptocurrencies. |

Fungible vs. Non-fungible

Cryptocurrencies like bitcoin or fiat currencies like the US dollar are fungible. Fungible assets can be traded with one another easily because they are interchangeable and indistinguishable. You can trade one can of soda for another, or a $1 note can be traded for any other $1 note of the same currency.

| Fiat Currency | A currency that is declared by government decree to be legal tender rather than backed by a commodity, such as gold. Examples include USD and EUR. |

Assets are non-fungible if they cannot always be equally exchanged with another asset of the same type. NFTs are non-fungible because each one is unique and represents ownership of a different item with its own characteristics. This doesn't mean they can't be traded. It only means that each token may have a different value.

| Non-fungible | A good or asset that is not readily interchangeable with another. For example, a house is non-fungible because you cannot exchange it with any other house. |

Subjective Value

If NFTs are non-fungible, how are their values determined?An NFT's value is subjective. It will sell for whatever price a buyer thinks it's worth. This may be based on the pedigree, popularity, scarcity, and/or collectibility of that NFT. Utility also determines an NFT's value. For example, an NFT event ticket would likely sell for the same price as a normal event ticket.

An NFT can be surprisingly expensive, especially if prospective buyers think it will become more valuable in the future. Also, NFTs built on the Ethereum blockchain often hold more value than NFTs built on other blockchains. Because more people have ETH tokens, these NFTs can be sold easily across numerous NFT marketplaces, increasing the number of potential buyers.

Scarcity

When a person mints an NFT, they can determine how many of those assets to create and list on the market. It's similar to an author releasing a limited number of copies of a new book.A digital artist may decide to create just one original NFT - for instance, a one-of-a-kind digital artwork. The creator could also release one thousand NFT artworks that look the same, each with its own unique certificate of authenticity.

Interoperability

Blockchains are decentralized. This means they aren't run by a central authority such as a government or business. Instead, blockchains are run by their communities. In theory, this allows NFTs to move across different applications, platforms, and services, as long as each ecosystem supports the blockchain where the NFTs are based.For example, an NFT of digital artwork could be displayed in several different virtual worlds you inhabit. The same NFT could be the background in your video conferencing app, an accessory in your favorite video game, and your picture profile for your work email.

Tradability

NFTs can be traded on NFT marketplaces and they can be moved from their original platform and into a free market.One day, NFTs could allow users to trade online content on major platforms. For example, if iTunes songs were coded as NFTs, you could not only buy, but also sell them.

Royalties

A person who mints an NFT can encode royalties into that asset through the NFT's smart contract. This means the original creator can receive a portion of the fee every time their NFT is sold from one user to the next.This is potentially industry-changing for creatives, who don't always receive adequate payment for their work. After the initial sale, creators often don't benefit if their creation gains value and is resold. For example, an artist who sells a painting for $10 doesn't profit if that piece later sells for millions of dollars.

Royalties in smart contracts make this compensation accessible to anyone who mints an NFT.

NFTs also create a guarantee that the artist will receive royalties. Musicians, for example, often don't receive payment from everyone who samples or plays their track for profit. By embedding their address within the NFT's unchangeable metadata, they both ensure they get paid, and also make it easy for users to pay them.

Security

NFTs have the potential to safekeep digital assets better than current methods. A scan of the deed to a house could easily be lost. Minting a scan of the same deed as an NFT means proof of the document exists on a blockchain. This adds a layer of security.Blockchain technology is secure because it uses cryptography to encode a token's ownership. This code requires an incomprehensible amount of computing power to break - essentially, making it impossible to decipher.

Each blockchain ledger is decentralized and anonymous. With no central authority or workforce, tasks are distributed equally between participating computers that form a peer-to-peer network.

| Peer-To-Peer | Networks whereby each connected computer is a server for others in the network. Computers can share information without the need for a dedicated central server. |

| Blockchain Node | An electronic device connected to a blockchain network that forms part of the infrastructure of that network. Multiple nodes communicate with one another and transfer data to verify new batches of transactions (called 'blocks'). |

That blockchains use peer-to-peer technology makes them nearly impossible to destroy or corrupt. Every node has an up-to-date copy of the ledger, and someone would have to destroy all of these nodes to wipe out the record of transactions and invalidate the blockchain.A blockchain's ledger is also public. Because they are accessible to anyone, ownership is easily verified, which again makes them difficult to steal unless someone tricks you into willingly transferring your NFTs.

Advocates of NFTs believe everyone could use them to represent and authenticate their physical assets. Even personal documents like deeds and drivers' licenses could be stored as NFTs.

Blockchain technology is very secure, and it's great for proving that someone owns an item - this proof will always be stored on a blockchain.

NFT Technology

NFTs are complicated and technical - but at their most basic are just strings of computer code stored on multiple computers. And knowing more about their history and how they developed can make them easier to understand.For starters, different cryptocurrencies and crypto assets are built on their own blockchains, and there are hundreds, if not thousands, of different blockchains. For example, bitcoins are built on the Bitcoin blockchain, and ERC-20 tokens are based on the Ethereum blockchain.

Some blockchains allow users to create non-fungible tokens in addition to fungible cryptocurrencies. The Ethereum blockchain is by far the most widely used blockchain for creating NFTs. However, there are others, including:

- Flow

- Binance Smart Chain

- Solana

- Tron

- Polkadot

- EOS

- Cosmos

- WAX

- Tezos

- Algorand

- Hedera Hashgraph

Some blockchains, including Ethereum, work with other compatible networks and coins, making them interoperable. Users can buy Ethereum-based NFTs with a variety of cryptocurrencies, including ETH, DAI, USDC, BNB, and USDT. Other blockchains, such as Solana, have closed systems and NFTs attached to these systems can only be bought with that blockchain's token.

Ethereum's popularity, liquidity, security, and portability across other apps, platforms, and products are part of what makes Ethereum-based NFTs such a popular choice.

Ethereum's token standards are also widely considered the best for creating NFTs. Token standards tell people how to create, issue, and deploy new tokens that are compatible across a broader ecosystem. Ethereum's blockchain has several useful standards:

- ERC-721 was the first and is still the most popular standard for creating unique NFTs. It's an Application Programming Interface (API) within the tokens' smart contracts. ERC-721 allows developers to create unique tokens and makes transerring the tokens easy and, after approval, automatic..

- ERC-1155 is a standard that gives semi-fungibility to NFTs. With ERC-1155, IDs represent classes of assets rather than single assets. For example, a single ID could contain 100 NFTs. This means that multiple NFTs can be transferred at once, but with less information about each one.

- ERC-998 is a composable token standard. These tokens can represent more than one asset at a time for quicker transactions. ERC-998 tokens can contain both fungible (such as ERC-20) and non-fungible (such as ERC-721) assets.

History of NFTs

NFTs have developed at a frighteningly fast pace, so you'd be forgiven for missing a few key dates.

2012

Colored coins were created on Bitcoin's blockchain to represent ownership of real-world things like coupons, property, and collectibles. Colored coins are thought by many to represent the beginning of NFTs. These tokens were rudimentary and lacked a lot of the use of today's NFTs. Nonetheless, they began a conversation about unique blockchain-based assets.

2014

The creation of Counterparty. Counterparty was a peer-to-peer financial platform, based on the Bitcoin blockchain, that allowed users to create and exchange their own currencies. Counterparty was important for the evolution of NFTs because the first NFTs on the platform resembled use cases that we recognize today. Several memes and games were placed on the platform as NFTs following its launch.

2016

The first Rare Pepe NFTs were introduced and quickly gained widespread popularity, effectively kickstarting the Crypto Art movement. Pepe NFTs became tradable with the introduction of Rare Pepe Wallets, and there was even a Rare Pepe auction in the following years.

2016 to 2019

The Crypto Art space continued to grow. NFT collections like CryptoPunks began to showcase the potential of NFT art and collectibles on the increasingly popular Ethereum blockchain. New NFT marketplaces like OpenSea, SuperRare, and KnownOrigin were launched, and NFTs could be created on platforms like Mintable and Mintbase.

2020

NFT marketplaces developed. Existing NFT marketplaces were updated and new platforms like Rarible and Cargo were released. Before 2020, NFT creators had to program smart contracts themselves if they wanted to add features like bulk creation and unlockable content to their NFTs. New platforms meant these features were now readily available during the NFT minting process.

2021

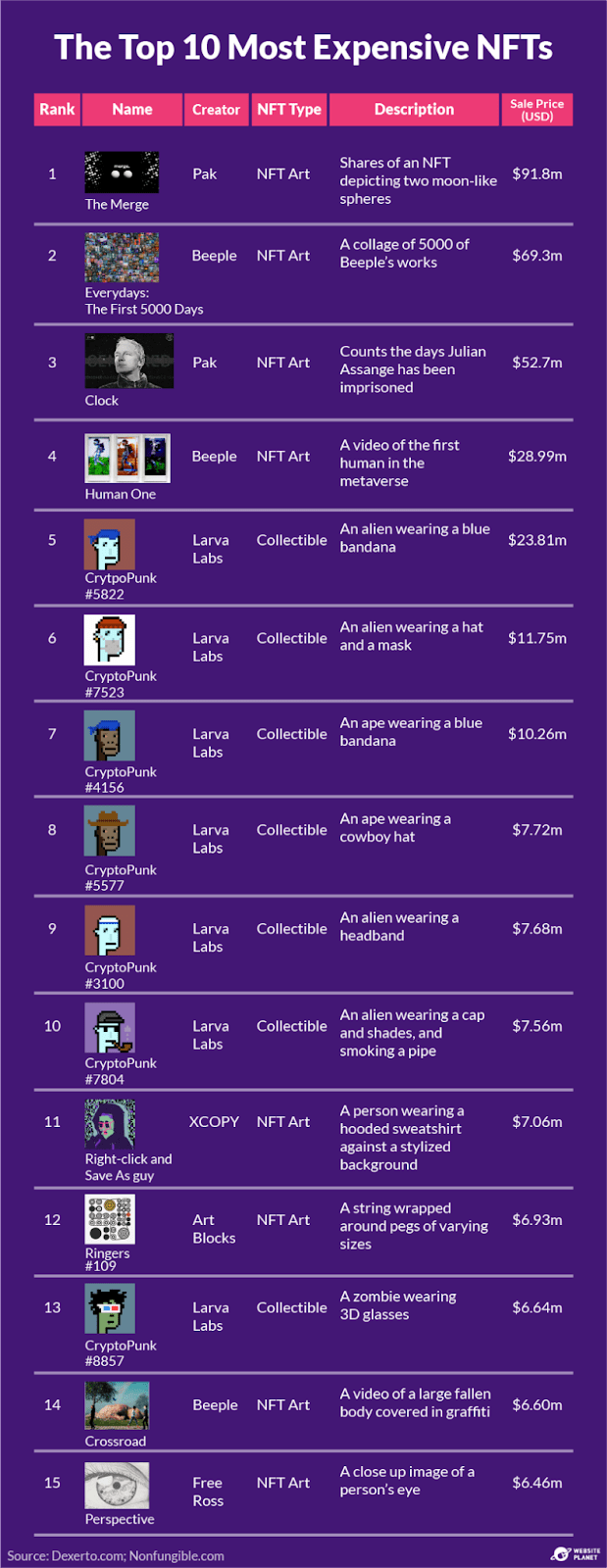

If 2020 was the year the wider public took notice of NFTs, 2021 was the year NFTs exploded. Celebrities and established brands became interested in NFTs and NFT art gained mainstream popularity. Beeple's 'Everydays: the First 5000 Days' sold for $69.3 million at Christie's art auction, only to be topped by the $91.8 million sale of Pak's 'The Merge' in early December.Pak's NFT was sold to more than 28,000 users who bought over 260,000 shares in his artwork - valuable proof of fractional ownership.

The first-ever Twitter post was sold as an NFT for $2.9 million in 2021. Over the year, CryptoPunks and Bored Ape Yacht Club NFTs routinely sold for hundreds of thousands of dollars and yesterday's memes were re-sold as today's NFTs. Songs, albums, and books were released as NFTs. Meanwhile, experts continue to develop new uses for NFTs outside of the creative industries.

A Complete Guide to NFT Marketplaces

NFT marketplaces are platforms where you can buy, sell, store, and display NFTs. In some cases, you can even create your own.When choosing an NFT marketplace, you should be very careful. Each one is compatible only with certain crypto wallets, cryptocurrencies, and types of NFTs. Most NFT marketplaces use Ethereum-based NFTs and accept ETH tokens, which is why Ethereum is so popular.

Other marketplaces may be designed for different blockchains. For example, Solsea is designed for Solana blockchain-based NFTs. There, you would need to link a wallet that's compatible with the platform and contains SOL cryptocurrency.

Each NFT marketplace may also cater to different types of content. NFT art marketplaces are the most common, but other niche marketplaces include in-game content, music, trading cards, and virtual real estate.

OpenSea, Rarible, and Axie Infinity are among the most popular NFT marketplaces. OpenSea is currently the biggest NFT marketplace, and showed colossal growth in 2021. In August of that year, OpenSea recorded over $75 million of trading volume in a single day. That's a higher total than the platform saw throughout the whole of 2020.

The marketplaces generally considered the best for buying and selling NFTs are:

- OpenSea is one of the earliest and biggest NFT marketplaces. It's an all-around user-friendly marketplace that features NFTs of digital artworks, collectibles, domain names, photography, music, utilities, virtual worlds, and sports.

- Rarible is decentralized and run by its community - owners of RARI tokens. In this sense, Rarible is something of a pioneer in the crypto space. Rarible focuses on art NFTs but also contains music, domains, in-game content, metaverse NFTs, and more.

- Nifty Gateway is all about digital art. The site contains NFTs from some of the biggest NFT artists like Beeple and Trevor Jones, not to mention famous NFT collections like Mutant Ape Yacht Club.

- Foundation is another artwork-centric NFT marketplace. Like Nifty Gateway, Foundation features some prominent NFT art and meme collections.

- SuperRare contains single-edition NFTs from top artists, including XCOPY and Coldie. The SuperRare DAO* is governed using $RARE tokens - ERC-20 tokens on Ethereum's blockchain.

- Mintable is an NFT marketplace solely designed for creating, buying, and selling NFTs. It's the closest thing to eBay for NFTs. Users can easily create NFTs from artworks, audio files, PDFs, and more.

- Axie Infinity is a game with its own huge NFT-fueled economy. The Axie Infinity marketplace contains over 270 million tokens. Players can collect 'axies' for use within the game. They can then battle each other with their axies, create new axies (by breeding them), and trade axies with other people.

- NBA Top Shot contains NFT trading cards which feature a short video of an iconic NBA moment. The marketplace is built on the Flow blockchain. Users can buy and sell these trading cards to one another.

- Decentraland is a massively popular NFT game with a market cap of US$6 billion. It's essentially a metaverse where users can trade virtual land and other in-game items.

| *Decentralized Autonomous Organization (DAO) | A decentralized organization that is governed by a community of its users. DAOs exist online and are organized based on rules encoded on a blockchain. |

How to Get Started on an NFT Marketplace

If you would like to buy, sell, and create NFTs, you need to start on an NFT marketplace.The process of signing up to an NFT marketplace ordinarily consists of a few straightforward steps.

Choose a marketplace > Sign up > Link a Crypto Wallet

NFT marketplaces require you to input some personal information when you create an account - the same as other online platforms. There are a couple of things you must consider before choosing a marketplace and creating/trading NFTs.

Choosing a Marketplace

This is the most important consideration before creating an account on an NFT marketplace. You'll want to join the best NFT marketplace for your needs.You need to choose a compatible marketplace that caters to the type of NFTs you want to buy, sell, and create. OpenSea is a reliable choice as it contains a huge variety of NFTs including art, collectibles, in-game items, and more.

We also recommend you choose an Ethereum-based NFT marketplace. Each blockchain that supports NFTs has its own compatible NFT marketplaces, wallets, and crypto tokens. Ethereum has more NFT marketplaces (and more NFTs) than any other blockchain.

Once you've signed up to the marketplace of your choice, you'll need to link a crypto wallet. Most marketplaces present you with a list of crypto wallets that you can use.

Choose a compatible wallet and sign up there as well. Your account set-up will be complete once you've linked your crypto wallet to your account.

Funding Your wallet

You need to have a cryptocurrency balance to trade on NFT marketplaces and pay 'gas.' Gas fees are transaction fees on the Ethereum blockchain.

| Gas Fees | Payments made by users of the Ethereum blockchain that cover the computing energy costs of maintaining the network. |

You must purchase the correct cryptocurrency, one that's compatible with your NFT marketplace. You need to buy ETH tokens to trade NFTs on an Ethereum-based NFT marketplace. You'll waste money if you buy the wrong cryptocurrency, such as bitcoin. Most wallet providers, including MetaMask, Enjin, and Coinbase, support ERC-721 tokens.

We recommend you buy around $100 of cryptocurrency from an exchange or broker and transfer it to your wallet. This should be enough ETH to cover the cost of creating or buying your first NFT.

What's a Cryptocurrency Exchange or Broker?

| Cryptocurrency Exchange | A platform that allows customers to buy and trade cryptocurrencies in exchange for other financial assets, such as fiat money or a different cryptocurrency. |

| Cryptocurrency Broker | A company or individual that acts as an intermediary between a cryptocurrency buyer or seller and the market. |

Multiple trades occur simultaneously on cryptocurrency exchanges, with platforms charging a set commission fee on each transaction. Anyone can buy cryptocurrency easily on exchanges using a credit card. Prices are instantly visible to anyone using the platform and largely determined by free-market factors like supply and demand. Coinbase.com and Crypto.com are two popular cryptocurrency exchanges.

Cryptocurrency brokers can offer a more personalized service to buyers and sellers. Brokers set the prices of cryptocurrencies themselves and usually facilitate higher-value trades. A prospective buyer would deposit their capital to the broker and can use that broker's additional products and services. These could include access to contract for differences (CFDs), derivatives, and market analysis tools. Popular brokers include Caleb & Brown and Bitpanda.

Both exchanges and brokers are reputable methods for trading cryptocurrency, though both methods also present opportunities for scammers and fraudsters. Only use well-known sites and widely recommended firms, and watch out for fake platforms or brokers.

How to Buy and Sell NFTs

Of course, each marketplace is slightly different. But if you've completed the sign up and you've connected a funded crypto wallet, you should be ready to buy and sell NFTs.

Buying NFTs

Buying an NFT is easy once you've funded your crypto wallet. The majority of NFT marketplaces use auctions and fixed-price 'Buy Now' sales.You can either buy NFTs on their initial release directly from the creator, or you can buy them on the secondary market. In-demand NFTs can increase in value over time, so it's often best to buy NFTs on their initial release. That's easier said than done; primary NFT auctions can be over in seconds. You'll need to make sure you have ample funds (and can react quickly) before attempting to bag an NFT on release.

You should look at several different, similar NFTs before committing to a purchase. You want to have a really good idea of the maximum and minimum price of an item before searching for a good value. Many NFT marketplaces show the 'lowest ask' and 'highest bid' for an NFT.

You should be mindful that scarcity, unique characteristics, and originality are desirable and increase the value of an NFT. Ownership history and the potential of future profitability also affect prices, while certain aesthetics are more fashionable than others. Consider these trends before buying an NFT, to ensure resale value.

Selling NFTs

Selling NFTs that you've bought or created may differ slightly depending on the marketplace but, generally, it's a simple process:Click Sell on an NFT > Choose Sale Conditions > List the NFT

Whether you're trading NFTs or releasing your own collection, you must balance getting the best value for your NFTs with some other strategies that can help in the long term.

At the very least, you need to be aware of the value of your NFT. One NFT trader accidentally sold a Bored Ape for just $2,844 in December 2021, a 'lapse of concentration' that meant the NFT was listed around $282,000 below its market value. With that in mind, let's look at some pricing tips so you can avoid making similar mistakes.

How to Price Your NFTs

NFT's are listed at a range of price points. There are two different ways to value your NFT based on its content.Supply and demand drive NFT values. If an NFT you're selling is a utility (i.e. it has an everyday use), you should value it according to its corresponding physical product. For example, an event will sell an NFT ticket for the same price as a physical ticket. In the resale market, that ticket could rise in value if there is high demand.

The value of non-utility NFTs is almost completely driven by supply and demand. Here are some factors that influence the perceived value of NFTs:

- Market demand

- Scarcity

- Originality

- Uniqueness

- Sentimentality

- Ownership history

- Potential return on investment

While you can predict some of these factors, others are solely down to the buyer. An NFT that is owned (or created) by someone famous will likely fetch larger sums of money. An NFT that is unique or original will probably be valued by the community as well.

You shouldn't overprice your NFT if you're the creator and this is its initial drop. The chances of your collection selling out will diminish if it's overpriced because you'll deny lower-income collectors from taking part. You want your collection to sell out to generate some hype.

This is also good practice because you want buyers to make a return on their investment. Otherwise, they simply won't invest. Many top collections maintain affordable drops even when they're in high demand.

When and Where Should You Sell NFTs?

Timing is crucial when releasing a collection or reselling a popular NFT. Run some marketing in the months before the sale to generate excitement and prime your customers.Sell your NFTs on more than one online platform. Most top NFT creators and collectors have multiple touchpoints with potential buyers, including social media accounts with links to purchase, a presence on top NFT marketplaces, and a website that integrates with these marketplaces - this way, supporters can go straight to their website to purchase their NFTs.

The NFT marketplace you choose needs to be based on the characteristics of your product. Are you selling a one-of-a-kind digital artwork? SuperRare is the best place to go. Are you selling NFT music? Try platforms like Catalog or OneOf. Unique One Photo is dedicated to NFT photography, while big platforms like OpenSea get exposure for loads of different categories.

You can also list a second-hand NFT on multiple marketplaces at the same time. This is great if you're reselling an NFT and want to increase its exposure.

How to Market NFTs

NFT creators and collectors use marketing channels to generate interest in their NFTs and build a community of supporters.Community members are actively engaged in buying and selling NFTs. You want to build this fanbase with marketing communications and the content of your NFTs. Establishing a community is crucial because it helps build credibility and excitement around your project, which ultimately translates into sales.

Successful NFT collectors and creators use multiple marketing channels to promote their NFTs, including:

- Community engagement

- Social media

- Websites

- Outreach to NFT influencers

- Donations of NFTs to influencers

- Advertisements

- Content marketing (informative blogs, videos for users)

- Mailing lists

- Airdrops & giveaways

- Pre-sale sign-ups

- Pre-sale NFTs

Discord, Twitter, and Reddit are popular with crypto supporters. You can join NFT groups on Discord and Reddit. On Twitter, you can use popular NFT hashtags to post content to the right audience.

Industry influencers are often used to promote NFT projects and sales. A few NFT marketplaces allow you to promote your NFTs on their homepage for a payment - another great way to find investors.

You could airdrop your first collection of common NFTs to 1000 people for free. This instantly creates an audience for your brand. These people could tell others about your NFTs or even buy in themselves. You could also ask influencers whether they would accept an NFT from your collection for free. Their fans will notice any new NFTs in their collection.

How to Mint Successful NFTs

Creating (or minting) an NFT is fairly straightforward. You don't need a background in cryptocurrencies or blockchain technologies to do it.

| Minting NFTs | Refers to the process of creating an NFT, which involves turning a digital file into an asset stored on a blockchain. |

First, navigate to an NFT marketplace where you can create NFTs. Not every marketplace allows you to do this, but for most that do, creating an NFT is a similar process.

Upload Content > Choose NFT Properties > Mint Your NFT

While these steps are fairly straightforward, you need to remember that some of the decisions you make here will affect the value of your NFT.

What Things Can You Mint as NFTs?

Most digital file formats can be turned into NFTs. This includes images, videos, audio files, and 3D models.

NFT Aesthetics

Artnome, FlashArt, and the Museum of Contemporary Digital Art studied the SuperRare marketplace's huge collection of NFTs. They found these common characteristics:- 3-D art is viewed more often and sells for higher prices than other NFTs.

Scarcity Affects the Price of Your NFT

You can receive more money per NFT if you mint and sell a single copy. But would you generate more money overall if you created 100 copies of your NFT and sold each one for less? The answer to that question depends, in part, on your NFT and the interest you expect it to generate.

Celebrities Join the NFT Trend

Some celebrities are unreservedly interested in NFTs, given that NFTs provide plenty of opportunities for artists and popular figures to monetize their fame.Many celebrities are taking advantage of the excitement surrounding NFTs by releasing collections.

Kings of Leon became the first band to release an album as an NFT, with a $50 version of When You See Yourself in March 2021. Several other artists, including Grimes and Steve Aoki have also released NFTs.

Other celebrities are avid collectors and collaborators. Snoop Dogg revealed he was @CozomoMedici in late 2021. @CozomoMedici is a previously anonymous NFT whale with a $17 million collection of Ethereum NFTs, including 9 CryptoPunks. Other famous NFT enthusiasts include YouTube personality Jake Paul and NBA star Steph Curry.

Real-World Uses of NFT Technology

2021 was a marquee year for non-fungible tokens. Sales by volume of Ethereum-based NFTs increased by over 17,000% in 2021.

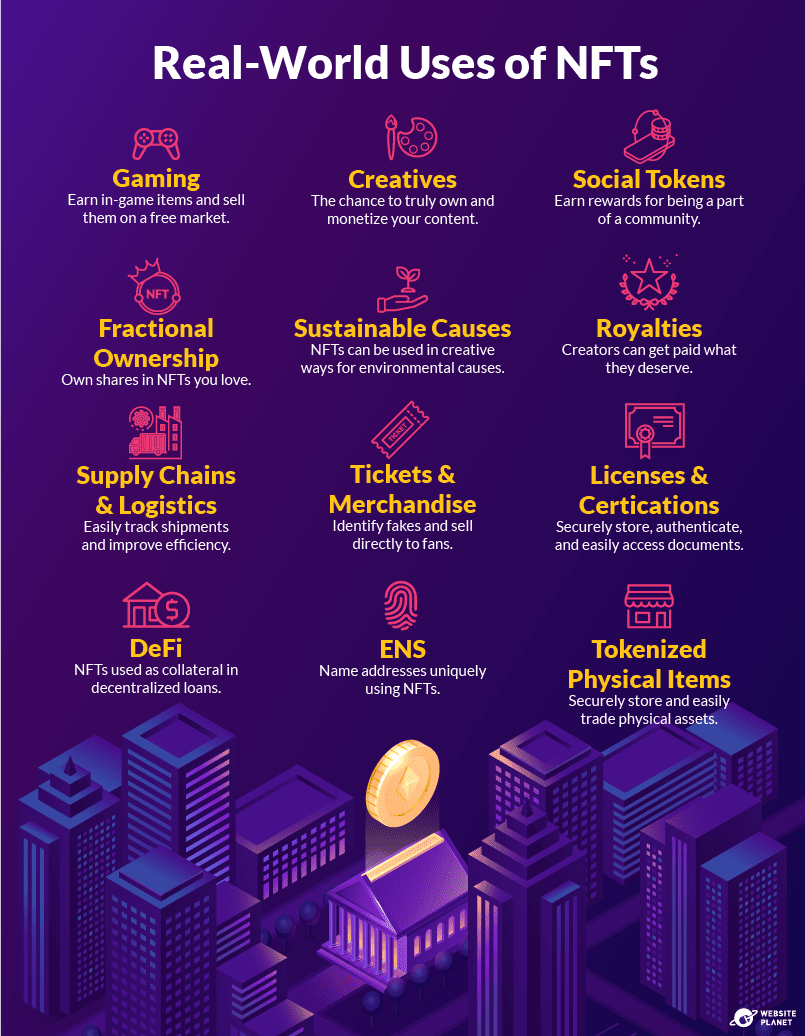

Many crypto experts believe NFTs will move beyond expensive artworks and premium collectibles to encompass everyday applications. So, what real-world uses do we have for NFTs, both now and moving forward?

A smart contract within an NFT proves the item's authenticity and validates its ownership. This allows several real-world uses that we've not yet seen in online content. Smart contracts can include royalties. This means the original creator of an NFT receives a percentage of an NFT's sale when it's transferred from one secondary owner to the next. NFTs have great potential for the creative industries. Royalties are one feature of smart contracts that can create passive income for creators.

The Future of NFTs

We're already seeing huge brands like Twitter release NFTs. More brands could follow, as NFTs continue to move into mainstream focus and companies seek new, engaging touchpoints with fans. One example would be rewarding fans with branded events, redeemable via unlockable content in NFTs. NFTs could well become a part of everyday life, used to represent a diverse range of assets in ways we can't yet imagine.Web 3.0 is a vision of the internet where everything is decentralized. That means the network is owned and run by the online community, rather than companies like Google and Facebook. As such, NFTs and their integration with concepts like the metaverse could eventually render big internet corporations obsolete.

NFTs are already used within the Decentralized Finance industry as they are increasingly adopted to represent financial assets. NFTs could play a part in decentralizing our financial system - bringing the benefits of transparency and democracy not only to the online world but to our global economy.

Frequently Asked Questions About NFTs

What Are NFTs?

NFTs are Non-Fungible Tokens, unique and unchangeable crypto tokens that are stored on a blockchain to represent the ownership of a digital or physical asset. NFTs can represent any number of things, including images, videos, and audio files.

What's the Point in NFTs?

NFTs allow creators to retain the ownership and profitability of their content while creating additional value for customers. For example, NFTs allow customers to resell the content they purchase. NFTs are meant to bring the concepts of scarcity and proof of ownership to digital items, and various uses are being developed that use these properties.

What Industries Use NFTs?

NFTs are primarily used to tokenize artists' creations and video game content. In the future, NFTs could be adopted across a range of sectors, including real estate, event ticketing, and logistics. People can display their NFTs on social media platforms, digital picture frames, and within metaverses.

What are the best wallets for NFT?

Now there are a large number of reliable and convenient wallets for storing and buying NFTs:

Are NFTs a Good Investment?

Some NFTs sell for tens of millions of dollars, and some collectors make large sums of money. That being said, the NFT market is unstable because it's such a new technology.

Who Makes NFTs?

Digital artists, software developers, and game developers create most of the high-profile NFT drops. More recently, musicians and other A-list celebrities have been creating NFTs as a way of monetizing their content. Big companies, such as Nike and Twitter, have been getting involved too.

Can You Sell NFTs?

NFTs are part of a free market just like items in the physical world. As such, you can buy and sell NFTs on the secondary market.

How Are NFTs Valued?

NFTs are based on the concept that an item is worth whatever the community deems it to be worth. The scarcity, popularity, and utility of an NFT often influence its value.

Where Are NFTs Traded?

NFTs can be bought and sold on dedicated NFT marketplaces like OpenSea, Rarible, and SuperRare.